Election Day was Tuesday, November 4, 2025

VIEW OFFICIAL FINAL ELECTION RESULTS (Full Canvassing Documents Pack)

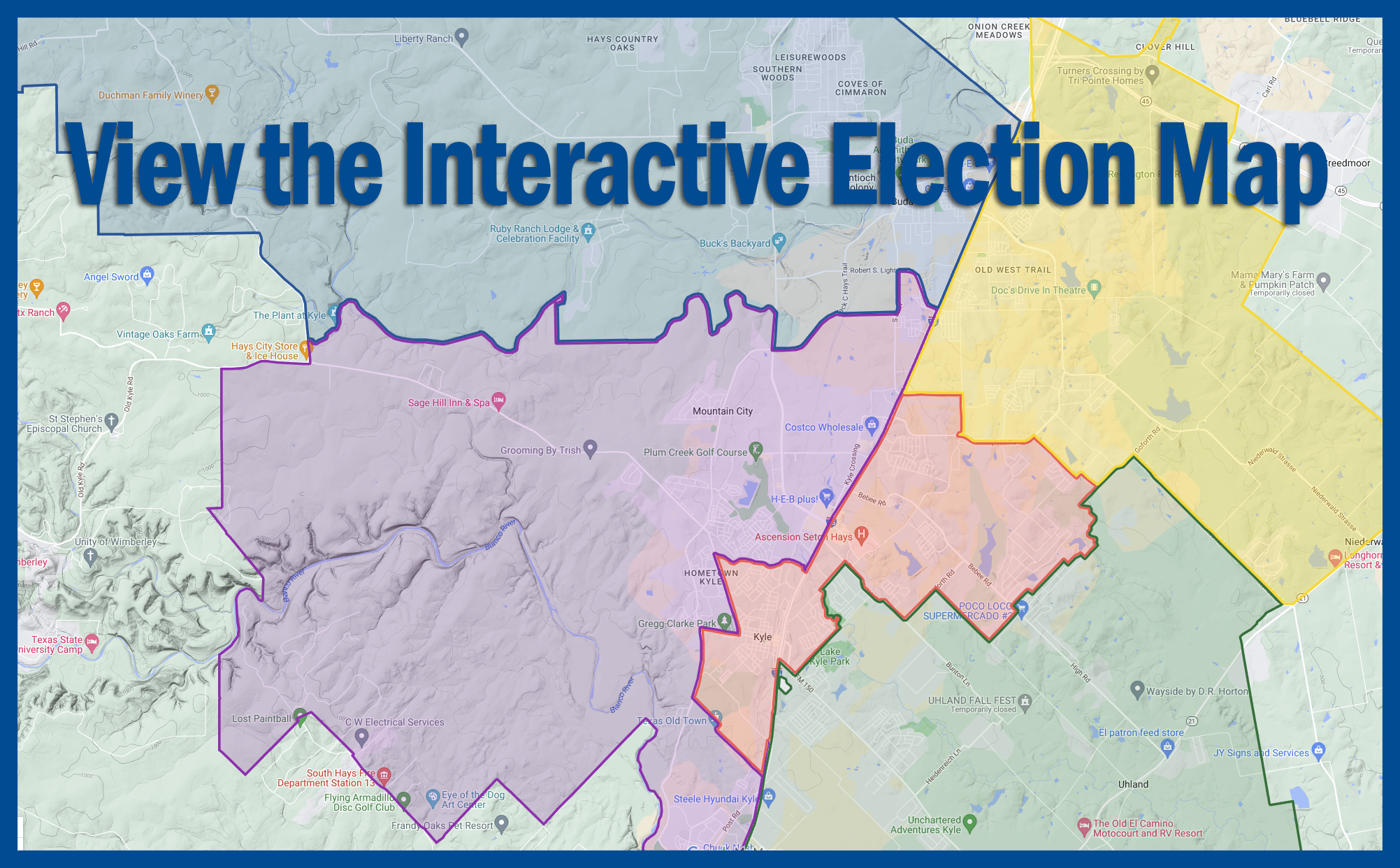

While the majority of ballots cast for this election come from Hays County, to calculate the total unofficial election results, you will need to add the results from all three counties together: Hays, Travis, and Caldwell.

Hays CISD Board Calls for a Voter-Approval Tax Rate Election (VATRE or TRE)

The Specifics Being Considered for a Hays CISD TRE

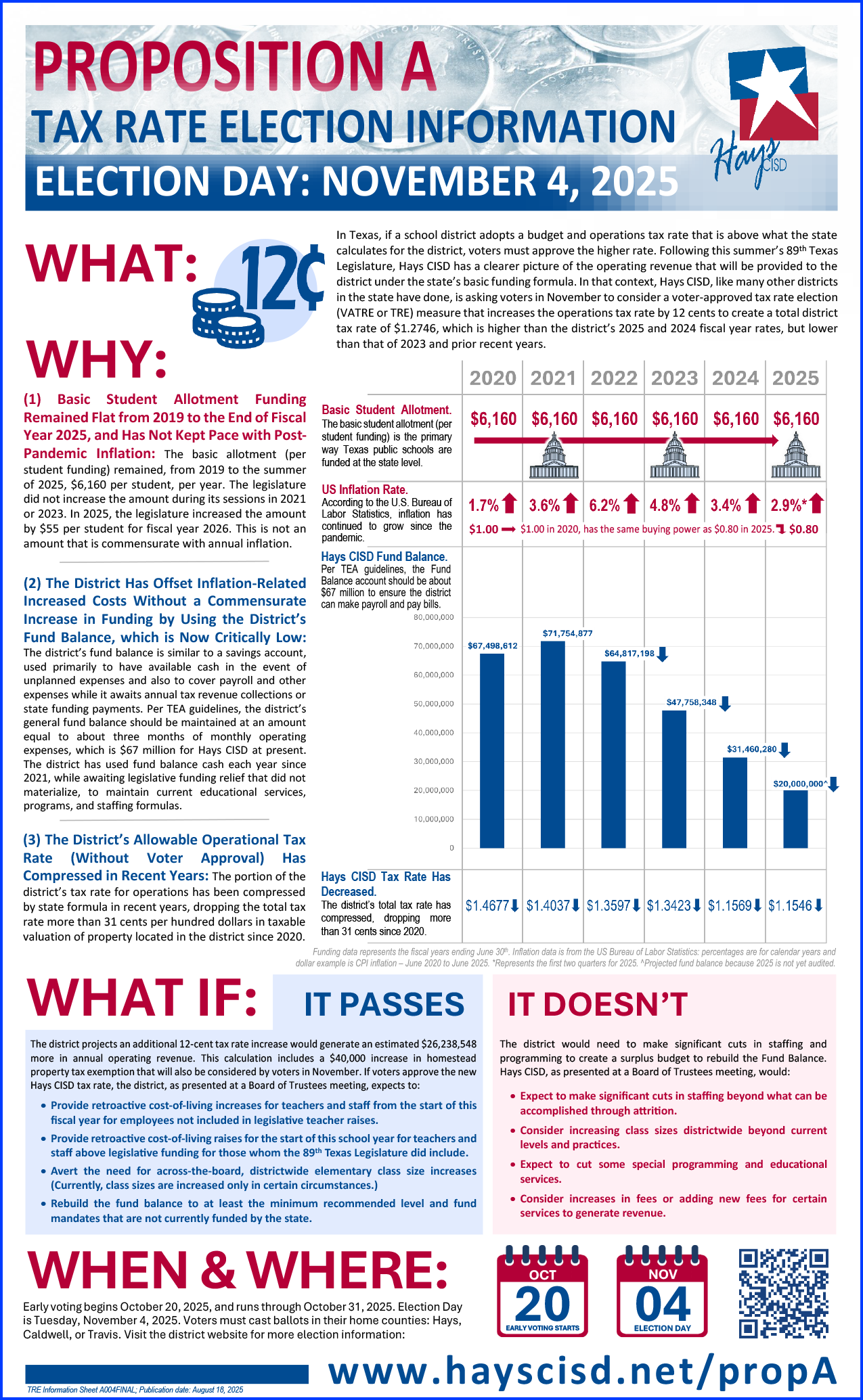

On August 18, 2025, The Hays CISD Board of Trustees voted unanimously to call for a tax rate election (TRE) to allow voters to consider a 12-cent maintenance and operations tax rate increase, bringing the total district tax rate to one that is higher than the last two previous fiscal years, but lower than that of fiscal year 2023. The higher tax rate, if approved by voters, is estimated to generate approximately $26 million in additional operational revenue.

School Funding in Texas

In Texas, if a school district adopts a budget and corresponding operations tax rate that is above what the state calculates for the district, voters must approve the higher operations rate in order for it to take effect. With the conclusion this summer of the 2025 legislative session, Hays CISD has a clearer picture of the operating revenue that will be provided to the district under the state’s basic funding formula. In that context, the district has called for the TRE.

Texas schools are funded primarily through two taxing streams – (1) the interest and sinking (I&S) tax, and (2) the maintenance and operations (M&O) tax.

The I&S tax is generally reserved for debt service issued on bonds to finance capital expenses like buildings, buses, equipment, and tangible long-term assets. Most voters are familiar with I&S funding through school bond elections. In fact, Hays CISD voters just approved a bond in May to build the district’s fourth comprehensive high school, among other important projects. The Hays CISD I&S tax rate would not increase, as promised, with a TRE.

The M&O tax covers the operating expenses for the district – teacher and staff salaries, insurance, utilities, bus fuel, supplies, student activities and projects – everything paid for by the district’s general operating fund. The M&O rate is calculated for Hays CISD by the Texas Education Agency through a series of funding formulas that take into account student attendance and the different needs of certain student groups.

Operational Funding Pressures in Hays CISD

Because state basic student allotment funding has not kept pace with inflation since 2019, Hays CISD is seeking voter approval to set a higher M&O tax rate than the state has determined for the district. Many other districts in Texas in recent years have employed this funding approach in order to maintain operations, attract and retain valued teachers and staff by continuing to offer competitive salaries and benefits, and to continue to provide important educational services for students.

Additional Information

In addition to potentially raising more operational revenue, should voters approve a TRE, the district intends to continue to find ways to cut operational expenses. Examples include eliminating additional positions through attrition, selling surplus district property, increasing capacity at our current campuses, and possibly delaying opening future schools to postpone the impact adding new campuses has on the operating budget.

*See the "Main Election Documents" below for all material required to be posted on the district's website.

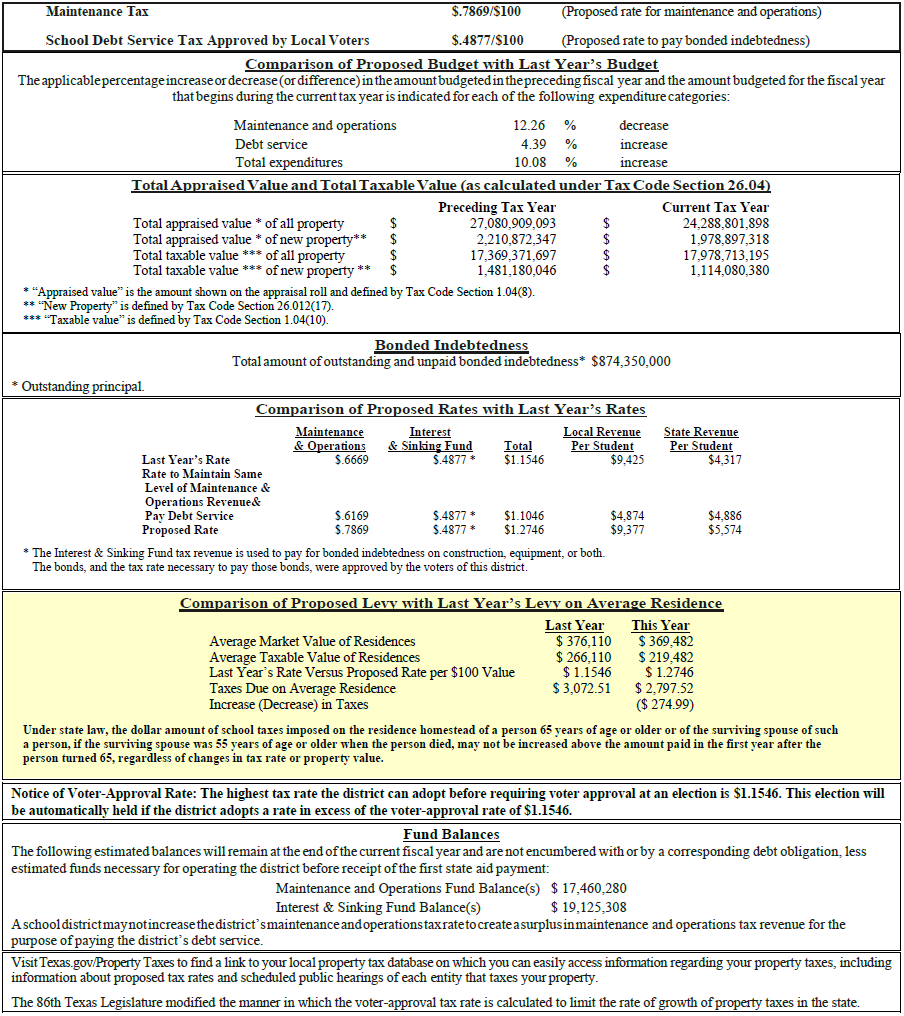

Tax Rate Chart

This chart is part of the information that the district published in advance of the formal public hearing in August regarding whether to call for a tax rate election. It is based on voters approving the November ballot statewide proposition to increase the property tax homestead exemption by $40,000.

2025 (November) Voting Times & Locations

Hays and Travis Counties use vote center counties, meaning Hays and Travis County voters may cast ballots for any election in which they are eligible at any vote center in the respective counties during the times the vote centers are operating. Caldwell County will have a specific polling location for early and election day voting.

Voting times and locations links will become active once the information is available. All voting information sheets are posted in English and Spanish.

Voter Registration

Voters registration is processed by the county in which a voter lives. Hays CISD includes portions of three counties. Use the links below to reach the county election offices.

To vote in the November 4, 2025, election, you must live in Hays CISD and your county must receive your voter registration by October 6, 2025.

Hays County

Travis County

Caldwell County

New voter registration cannot be completed entirely online. Printed applications must be returned to county election offices with original signatures either in person or through the U.S. mail system.